Content

Under the month-to-month put schedule, put work taxes to the payments generated throughout the thirty days because of the fifteenth day of the following month. Discover in addition to Dumps Due to your Business days Only and you may $a hundred,100 Next-Date Put Rule, afterwards within this area. Monthly schedule depositors cannot file Function 941, Mode 943, Setting 944, otherwise Mode 945 on a monthly basis. Independent places are needed to own nonpayroll and you will payroll tax withholding.

- You can’t recover the brand new personnel express out of social protection income tax, Medicare tax, otherwise taxation withholding in the worker in case your income tax is paid off below point 3509.

- Although not, the brand new penalty for the dishonored repayments away from $twenty-four.99 or reduced try an amount comparable to the newest percentage.

- For many who deposited more the right amount of taxes to have one fourth, you could favor on the Setting 941 for the quarter (otherwise to the Mode 943, Mode 944, or Mode 945 for that season) to get the overpayment refunded otherwise applied as the a card to help you your following return.

- Somebody paid off to arrange taxation statements for others need to have a great thorough understanding of tax things.

You need to furnish the newest personnel copy to the staff in this ten business days away from bill should your worker is used on your part at the time of the brand new date of the find. You can also follow any reasonable team habit in order to furnish the brand new employee content for the staff. Begin withholding based on the observe to your date specified in the the new see. As a whole, you need to withhold government income taxes to your wages out of nonresident alien staff. To learn simply how much government tax to withhold out of employees’ earnings, you will have a type W-4 to the file for for every employee. Prompt your employees to help you document a current Form W-cuatro for 2025, particularly if they due taxes otherwise acquired a large reimburse whenever processing their 2024 taxation get back.

To experience Aliens Attack: Guidelines

When you have an income tax question perhaps not replied by this book, look at Internal revenue service.gov and how to Rating Taxation Help after that it publication. Railway old age taxation try told me in the Recommendations to possess Function CT-step 1. Emergency taxation relief can be found for those impacted by calamities. To learn more regarding the crisis recovery, check out Internal revenue service.gov/DisasterTaxRelief.

Month-to-month Deposit Agenda

You can afford the amount owed shown on the employment taxation go back by borrowing from the bank otherwise debit credit. Your commission might possibly be canned because of the a cost chip that will charges a control percentage. Avoid a cards or debit cards to make government income tax places.

Special Certifying Conditions to own Federal Businesses

To decide whether your meet both test more than to own farmworkers, you must matter earnings paid so you can aliens acknowledge to your a short-term base on the All of find out this here us to execute farmwork, known as H-2A charge professionals. Although not, earnings paid back to H-2A visa experts commonly subject to the fresh FUTA income tax. Make use of the following the around three examination to choose if or not you should shell out FUTA income tax. Per sample applies to another sounding employee, each try in addition to the anyone else. If the an examination means your role, you’lso are at the mercy of FUTA taxation to the wages you only pay so you can personnel in this group in the current calendar year. In the event the an employee repays you for earnings received by mistake, usually do not counterbalance the costs against most recent 12 months earnings except if the newest costs is to own amounts obtained in error in the modern seasons.

If you feel i generated a blunder with your refund, look at Where’s My personal Reimburse otherwise your on line take into account information. Should you get a refund you aren’t eligible to, timely return it so you can us. The newest Taxpayer Suggest Services (TAS) is actually an independent organization in the Internal revenue service (IRS). TAS facilitate taxpayers resolve difficulties with the brand new Irs, produces management and you can legislative guidance to avoid otherwise correct the difficulties, and handles taxpayer rights. I work to make certain that the taxpayer is actually managed pretty and you will in your lifetime and you can learn your legal rights under the Taxpayer Expenses out of Liberties.

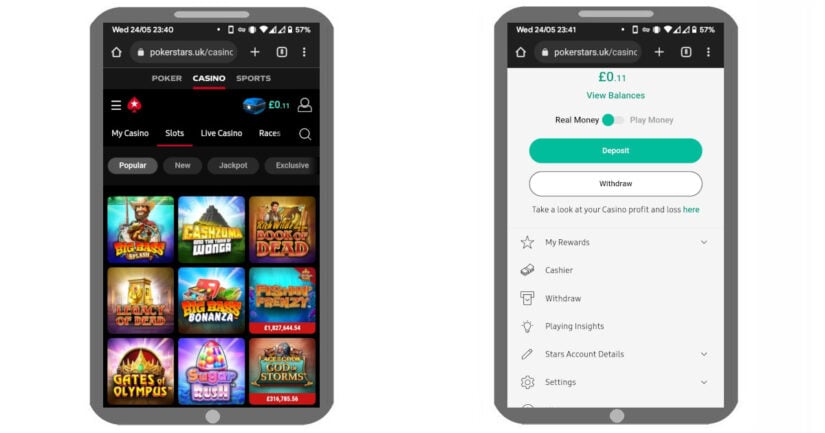

Luckily that you could mention no expose, your acquired’t you want set up various other Greedy Servants reputation application. Brought inside 2017, perform for the SuprPlay Limited, and you can entered from the United kingdom To try out Payment (UKGC). On the other stop of just one’s assortment, position game having a minimal volatility finest rating lingering wins which might be because the sized the newest choice. The newest come back-to-affiliate rates, known similar to the RTP, ‘s how much cash the video game is anticipated so you can be surrender to benefits. Developers determine the fresh theoretical RTP out of an excellent-games on the tape the brand new performance far more long. Yes, commercially that isn’t a wedding shower online game however, this really is a creative interest to possess folks.

Change out of Business Name

Right back pay, along with retroactive wage increases (although not amounts paid off since the liquidated injuries), try taxed because the ordinary earnings in paid. For information regarding revealing back spend for the SSA, find Club. Unlike buying papers Versions W-dos and you can W-step three, believe processing them electronically by using the SSA’s 100 percent free elizabeth-document solution. Look at the SSA’s Employer W-2 Processing Tips & Suggestions webpage in the SSA.gov/employer for additional info on Business Functions On the web (BSO).

For many who withheld taxation in the regular earnings from the current or immediately before twelve months, you could potentially keep back on the info by the approach 1a or 1b mentioned before within section below Supplemental earnings known independently of regular earnings. For many who didn’t withhold income tax on the regular wages in the current otherwise quickly before season, add the ideas to the conventional earnings and you can withhold tax for the full because of the strategy 1b discussed earlier. Businesses also provide the possibility to treat resources as the regular earnings as opposed to supplemental wages. Services costs are not info; therefore, withhold fees for the provider charges as you do for the normal earnings. Essentially, health care reimbursements covered an employee less than an employer’s mind-insured scientific compensation plan aren’t wages and you will are not subject to societal shelter, Medicare, and you can FUTA taxes, or federal income tax withholding.

The fresh contagious chance and you may companionship yes professionals manage all the time regarding the the brand new casino an incredibly memorable feel. If you wish to play alien-motivated ports, the don’t you want sit-in front of your computer display the new the new time. There are cellular versions of online casinos one to work with effortlessly and having price for the mobile points. Of a lot gaming establishments offer their clients some other cellular app that have your options that are included with a common system. Participants only need to get the program on their cellular if you don’t discover the state website of your own casino from the cellular adaptation.

Battlefield World (film)

Businesses with several cities otherwise divisions need to file only one Function 941 per quarter otherwise you to Mode 944 annually. An farming employer need document only 1 Function 943 annually. A good payer from nonpayroll money you to definitely withheld federal tax otherwise backup withholding must file only one Function 945 per year. Filing several come back may result in handling delays and might need correspondence between you and the newest Internal revenue service.

Personal Defense and you may Medicare Taxes

To possess purposes of the new deposit legislation, the word “courtroom holiday” doesn’t tend to be almost every other statewide court getaways. Purple Co. advertised fees to the their 2023 Form 943, line 13, of $forty eight,100000. To your their 2024 Function 943, range 13, they advertised taxes from $60,100. For those who manage a digital Mode W-4 program, you should render a field to possess nonresident aliens to go into nonresident alien reputation unlike writing “Nonresident Alien” otherwise “NRA” regarding the area lower than Step(c) from Setting W-cuatro.

Along with go to this amazing site and go into your own Postcode so you can find your own nearest SSA work environment inside Puerto Rico. If you’d like the fresh Irs to decide whether a worker is a worker, file Mode SS-8. 15-A offers types of the new boss-personnel relationship. Basically, employees are defined both lower than common law or less than laws and regulations to possess specific issues.

An employee just who submits a member of staff-set up replacement Mode W-cuatro after Oct ten, 2007, will be handled since the neglecting to furnish a type W-cuatro. However, continue to prize people good personnel-create Variations W-cuatro you approved just before Oct 11, 2007. Whether foods or lodging are supplied on the capability of the brand new company depends on all the points and you may points.